All Categories

Featured

State Farm agents offer every little thing from house owners to car, life, and other prominent insurance products. It's easy for representatives to pack services for discounts and easy strategy monitoring. Several customers appreciate having one trusted representative deal with all their insurance policy requires. State Farm provides global, survivorship, and joint universal life insurance policy plans.

State Ranch life insurance is usually conventional, offering steady options for the ordinary American family members. If you're looking for the wealth-building opportunities of global life, State Ranch does not have competitive alternatives. Read our State Ranch Life Insurance review. Nationwide Life Insurance Policy offers all kinds of global life insurance policy: global, variable universal, indexed global, and global survivorship plans.

Still, Nationwide life insurance coverage plans are very easily accessible to American families. It assists interested parties obtain their foot in the door with a trusted life insurance plan without the much more difficult discussions about financial investments, monetary indices, etc.

Even if the worst takes place and you can't obtain a larger strategy, having the security of a Nationwide life insurance coverage plan could transform a buyer's end-of-life experience. Insurance coverage firms make use of clinical examinations to determine your risk class when using for life insurance policy.

Purchasers have the option to change prices monthly based on life situations. Of program, MassMutual uses interesting and possibly fast-growing opportunities. However, these plans have a tendency to carry out best in the future when early deposits are higher. A MassMutual life insurance policy representative or monetary expert can assist purchasers make strategies with area for changes to meet short-term and long-term economic objectives.

Index Linked Insurance Products

Some customers may be amazed that it offers its life insurance policy plans to the basic public. Still, military participants delight in unique benefits. Your USAA plan comes with a Life Event Option biker.

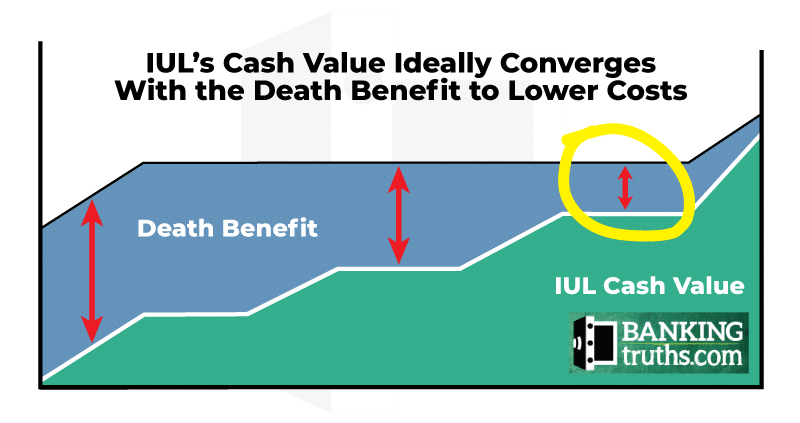

VULs include the highest possible threat and one of the most prospective gains. If your plan does not have a no-lapse guarantee, you may even shed protection if your money worth dips below a particular threshold. With a lot riding on your investments, VULs call for constant attention and upkeep. It might not be a great choice for individuals that merely desire a death benefit.

There's a handful of metrics whereby you can judge an insurance coverage business. The J.D. Power consumer satisfaction rating is a good choice if you want an idea of just how consumers like their insurance plan. AM Best's monetary stamina score is an additional crucial metric to think about when selecting a global life insurance coverage business.

This is especially important, as your cash money worth expands based upon the financial investment options that an insurance policy firm provides. You should see what financial investment options your insurance company deals and contrast it versus the objectives you have for your plan. The most effective way to locate life insurance coverage is to collect quotes from as many life insurance business as you can to recognize what you'll pay with each plan.

Latest Posts

Life Insurance Tax Free Growth

Iul Investment Calculator

What Is The Difference Between Universal And Whole Life Insurance