All Categories

Featured

Table of Contents

Indexed Universal Life (IUL) insurance coverage is a kind of long-term life insurance coverage plan that combines the features of traditional universal life insurance with the capacity for cash money worth development linked to the performance of a stock market index, such as the S&P 500 (IUL policy). Like other kinds of long-term life insurance policy, IUL supplies a death benefit that pays to the beneficiaries when the insured dies

Cash value accumulation: A section of the premium repayments enters into a cash money value account, which makes interest gradually. This money value can be accessed or obtained versus throughout the insurance holder's life time. Indexing alternative: IUL plans use the chance for cash money value growth based on the performance of a stock market index.

What is the best Iul Premium Options option?

Just like all life insurance policy products, there is additionally a set of risks that policyholders must recognize before considering this kind of plan: Market risk: Among the main dangers related to IUL is market threat. Given that the money worth development is connected to the efficiency of a securities market index, if the index chokes up, the cash value might not expand as expected.

Adequate liquidity: Policyholders must have a secure economic scenario and fit with the superior repayment demands of the IUL policy. IUL enables adaptable premium payments within specific restrictions, however it's important to maintain the plan to ensure it achieves its intended goals. Rate of interest in life insurance policy coverage: People that need life insurance coverage and an interest in cash worth development may discover IUL appealing.

Prospects for IUL need to have the ability to comprehend the mechanics of the plan. IUL may not be the most effective alternative for people with a high tolerance for market threat, those who prioritize inexpensive financial investments, or those with more immediate financial requirements. Consulting with a qualified financial advisor who can give customized advice is important prior to thinking about an IUL plan.

All registrants will certainly receive a schedule invitation and web link to sign up with the webinar by means of Zoom. Can not make it live? Register anyhow and we'll send you a recording of the presentation the next day.

What is a simple explanation of Indexed Universal Life Insurance?

You can underpay or avoid costs, plus you might have the ability to adjust your fatality benefit. What makes IUL different is the means the cash worth is spent. When you obtain an indexed global life insurance policy plan, the insurer offers a number of alternatives to choose at least one index to use for all or part of the cash worth account segment of your policy and your survivor benefit.

Cash money worth, along with potential development of that worth through an equity index account. An option to designate part of the money worth to a set passion choice.

Insurance policy holders can determine the percentage assigned to the repaired and indexed accounts. The value of the chosen index is videotaped at the beginning of the month and compared with the worth at the end of the month. If the index boosts throughout the month, rate of interest is contributed to the money worth.

The 6% is increased by the money worth. The resulting rate of interest is contributed to the money value. Some plans calculate the index gains as the sum of the adjustments for the duration, while various other plans take an average of the everyday gains for a month. No passion is credited to the cash money account if the index goes down as opposed to up.

How do I get Iul Death Benefit?

The rate is established by the insurance policy firm and can be anywhere from 25% to greater than 100%. (The insurance provider can also change the participate price over the lifetime of the policy.) As an example, if the gain is 6%, the engagement rate is 50%, and the existing money worth overall is $10,000, $300 is contributed to the cash money value (6% x 50% x $10,000 = $300).

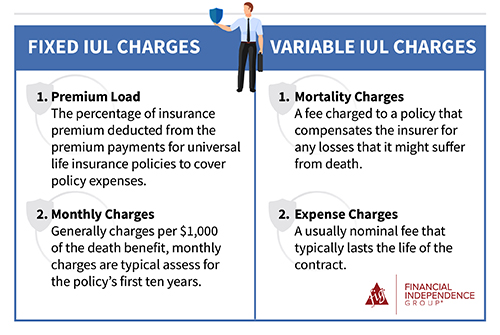

There are a number of advantages and disadvantages to consider before acquiring an IUL policy.: As with basic universal life insurance policy, the insurance holder can enhance their premiums or lower them in times of hardship.: Quantities credited to the cash money worth expand tax-deferred. The cash money value can pay the insurance premiums, allowing the insurance holder to reduce or quit making out-of-pocket premium settlements.

Who are the cheapest Tax-advantaged Iul providers?

Many IUL plans have a later maturity date than various other kinds of global life policies, with some ending when the insured reaches age 121 or even more. If the insured is still active at that time, plans pay the death benefit (yet not generally the cash worth) and the profits may be taxable.

: Smaller sized plan stated value don't supply much benefit over regular UL insurance policy policies.: If the index decreases, no rate of interest is attributed to the money value. (Some plans supply a low assured price over a longer duration.) Other investment cars make use of market indexes as a criteria for efficiency.

With IUL, the objective is to benefit from higher motions in the index.: Because the insurer only purchases options in an index, you're not directly purchased supplies, so you don't benefit when business pay dividends to shareholders.: Insurers charge fees for managing your cash, which can drain cash money worth.

What types of Iul Retirement Planning are available?

For most individuals, no, IUL isn't far better than a 401(k) - Indexed Universal Life interest crediting in terms of saving for retirement. Many IULs are best for high-net-worth individuals seeking ways to reduce their gross income or those that have maxed out their other retirement alternatives. For everyone else, a 401(k) is a better investment automobile since it doesn't bring the high costs and premiums of an IUL, plus there is no cap on the quantity you might make (unlike with an IUL policy)

, the earnings on your IUL will certainly not be as high as a regular financial investment account. The high expense of premiums and fees makes IULs pricey and substantially less cost effective than term life.

Indexed universal life (IUL) insurance policy uses money worth plus a death advantage. The money in the cash value account can gain passion with tracking an equity index, and with some often designated to a fixed-rate account. Nevertheless, Indexed global life plans cap exactly how much money you can build up (frequently at less than 100%) and they are based on a perhaps volatile equity index.

What should I look for in a Indexed Universal Life Accumulation plan?

A 401(k) is a far better choice for that objective because it does not carry the high charges and costs of an IUL policy, plus there is no cap on the amount you may earn when spent. The majority of IUL plans are best for high-net-worth people seeking to reduce their gross income. Investopedia does not supply tax obligation, financial investment, or economic services and guidance.

If you're taking into consideration purchasing an indexed universal life plan, first consult with a monetary advisor that can discuss the nuances and offer you a precise photo of the real potential of an IUL policy. Make certain you understand how the insurance company will compute your rate of interest, revenues cap, and fees that could be evaluated.

Latest Posts

Life Insurance Tax Free Growth

Iul Investment Calculator

What Is The Difference Between Universal And Whole Life Insurance